I pointed out above that I am not a great forecaster of economics or of the market as a whole so the above discussion may not mean inflation moderates further, or that Fed Rate hikes stay below a one percent total in 2023, or that we avoid a deep recession – all of which could be further negatives for the market. Additionally, more and more companies are announcing layoffs, particularly in the Tech sector. If this persists, the theory is that inflation will moderate further. While jobs growth of this amount might lead to wage growth of substance, the growth in December was a fairly normal 0.3%. This was substantially lower then where it had been at the end of 2021 (637,000 in Q4). Jobs growth remained solid but not overly strong growing at 247,000 for the prior three months. That is why the December labor report was comforting. Of course, there is another issue for bears to jump on – the potential for a recession. If inflation continues to ease, The Fed can keep rate hikes in line with or below their stated target and market conditions should improve. In November, inflation was down to 7.11% and decreased further in December to 6.45%. So, the big question in 2023 is whether the expected additional rate increases projected at just under 1% for the year (which theoretically is built into current share prices) is enough for The Fed. When rates increase the market tends to decline and high growth stocks decline even faster. A primary weapon is increasing the Fed Rate which they did 7 times in 2022 with the total increase of 4.25% being the largest amount in 27 years. When the rate kept increasing in the first half of 2022 the Feds began to act aggressively. It began to increase in 2021 (up to 4.7%) but many thought this was temporary due to easing of the pandemic. To put this in perspective, in the 9 years from 2012 to 2020, inflation was between 0.12% and 2.44% with 6 of the years below 2.0%.

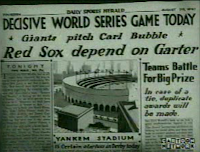

#Baseball broadcast soundbyte drivers

Two key drivers of negative market conditions in 2022 were the huge spike in inflation coupled by the Fed raising rates to battle it. But even great company’s stock performance can be heavily impacted in any given year by market conditions. What went wrong for my stock picks in 2022? I have always pointed out that I am not amongst the best at forecasting the market as a whole but have been very strong at selecting great companies which over the long term (5 years or more) typically have solid stock appreciation if their operating performance is consistently good. On the other hand, I believe this creates a unique opportunity to invest in some great companies at prices I believe are extremely compelling. On the one hand I’m mortified that stocks that I selected have declined precipitously not only impacting my personal investment portfolio but also those of you who have acted on my recommendations. Every brand needs a portfolio of resources to accommodate the volume and range of work that needs to get done.2022 was one of the worst years in the past 50 for the stock market in general, and for my stocks in particular. The production portfolio everything from Hollywood class production to cheap & cheerful and tech enabled. Cost/value analysis map all potential marketing initiatives based on the financial/resource cost vs expected results into four quadrants – high/high, high/low, low/high, low/low. Influencer marketing needs to actually i nfluence behavior. Influencers with Influence we love reach and boxcar numbers, but that’s for mass advertising that builds awareness.

Be careful of the endless money pit that comes from trying to be ‘perfect.’ At some point, a dollar spent on better attribution only produces 99 cents of value. A+ Attribution without this, you might as well go home.

#Baseball broadcast soundbyte how to

Fast, cheap and good….here’s how to do all three. The Content Firehose we need to make so much so fast, but can’t pay too much. A simple test can tell you if you really ‘own’ a positioning. We know how to stake out a positioning, but more importantly, hold it for decades. Agency Growth Secrets we can’t tell you, or it wouldn’t be a secret, now would it? Positioning with a Moat the notion of ‘owning’ a positioning is one of the most misused expressions in the industry. Replacing the Crumbling Cookie the cookie is already dead, but no one has the solution. No one makes B2B decisions alone (and survives to tell about it). One soundbyte that appeals to all decision makers, across departments. The Universal B2B Soundbyte no one ever got fired for hiring IBM/Goldman Sachs/Accenture….this is the key.

0 kommentar(er)

0 kommentar(er)